Chinese Stimulus Sparks Melt-Up in Gold, Silver, and Mining ETFs.

Overview: The markets were sniffing the Chinese stimulus days before it was official. All assets are in a melt-up mode; GDX led the parade, and finally, SIL caught up. The bull market in precious metals has been confirmed.

Once again, the principle of confirmation saved our skin by negating a bear market signal that would have been a horrible whipsaw. SIL dropped to bear market levels, while GDX refuse to confirm. As a reminder, according to the Dow Theory, the principle of confirmation states that for a market trend to be considered valid and reliable, higher highs (or lower lows) by one Index or asset must be confirmed by another one.

You may read these posts (here and here) to see recent instances when the principle of confirmation prevented us from taking a losing trade.

General Remarks:

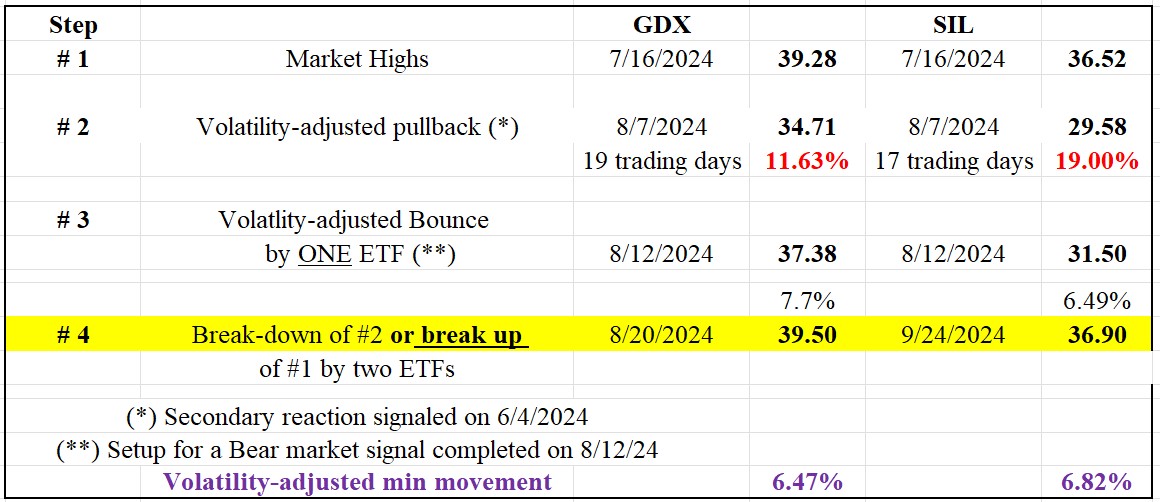

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

SIL refers to the Silver Miners ETF. More information about SIL can be found HERE.

GDX refers to the Gold Miners ETF. More information about GDX can be found HERE.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

As I explained in this post, the primary trend was signaled as bullish on 4/3/24.

In this post, I explained that following a secondary (bearish) reaction, a rally ensued that completed the setup for a potential primary bear market. Please mind the word “potential”.

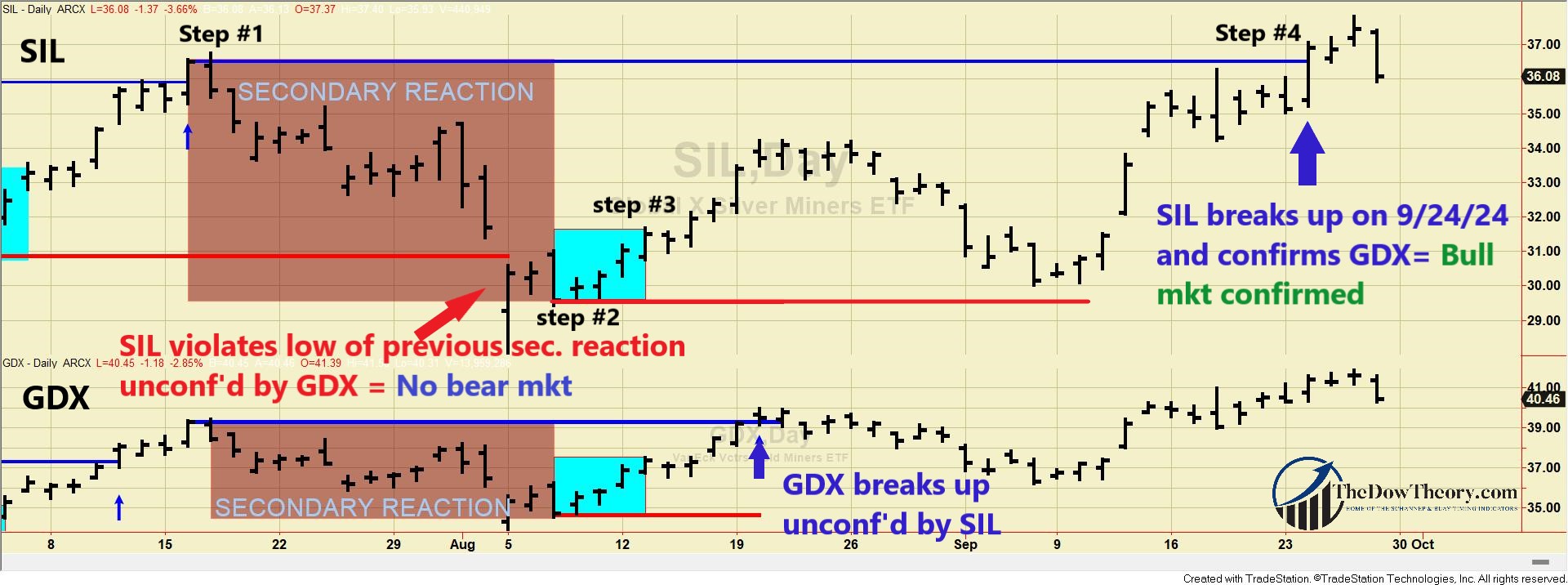

On 8/5/24, SIL pierced its 7/1/24 secondary reaction lows unconfirmed by GDX. GDX’s lack of confirmation means that no primary bear market was signaled.

On 8/20/24, GDX surpassed its last recorded 7/16/24 highs, unconfirmed by SIL. SIL’s lack of confirmation meant that the bull market and setup for a potential bear market had not been canceled.

So, we had a double non-confirmation: Neither bearish nor bullish price action was confirmed, which means that the existing primary bullish trend remain in force.

Finally, on 9/24/24, SIL broke topside its 7/16/24 highs, thereby confirming GDX, and accordingly:

- The primary bull market has been reaffirmed.

- The secondary (bearish) reaction against the primary bull market has been terminated.

- The setup for the potential bear market signal has been canceled.

The table below contains the key prices and dates:

The chart below illustrates the latest price movements. The brown rectangles mark the secondary reaction against the primary bull market (Step #2). The blue rectangles indicate the rally (Step #3), positioning GDX and SIL for a potential bear market signal. The red horizontal lines show the secondary reaction lows (Step #2), where a confirmed break would signal a new primary bear market. Meanwhile, the blue horizontal lines highlight the last recorded bull market highs (Step #1), where a confirmed breakout would reinforce the primary bull market.

So, now the primary and secondary trends are bullish.

So, now the primary and secondary trends are bullish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

I explained in this post that the primary trend was signaled as bullish on 4/2/24.

In this instance, the long-term application of the Dow Theory coincides with the shorter-term version, so there was a secondary reaction against the primary bull market and higher highs have canceled the secondary reaction.

So, now the primary and secondary trends are bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com